Bitcoin is currently at a record high. However, the investment experts at JPMorgan are now warning all investors and potential investors in the cryptocurrency. In their opinion, a deep price drop is imminent. The reason behind this sounds quite plausible.

Bitcoin’s rollercoaster ride

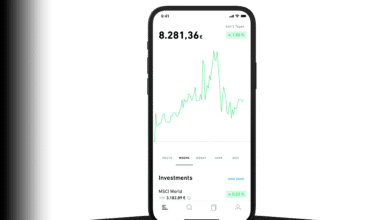

Anyone looking for a safe investment should urgently stay away from cryptocurrencies. The risk of loss is too high. Bitcoin is a prime example of this. In June 2022, for example, the most popular representative of digital currencies took a real nosedive in terms of market value. However, the value of less than USD 20,000 at the time seems to have been forgotten by cryptocurrency investors. On March 5, 2024, the price of Bitcoin was over USD 69,000. This is a new record. However, according to investment bank JPMorgan, this high will also be followed by a deep fall.

The cause of the impending crash is believed to be the halving of Bitcoin. This makes mining bitcoins more expensive. After all, the reward for mining new coins is to be halved without further ado. Analysts believe that this could cause the price to plummet to USD 42,000 as early as April. This sharp drop would probably be a new record – but in a negative sense. This is the conclusion of a report by finanzen.net, which sets out the investment bank’s assessment in detail.

Is JPMorgan too subjective?

However, it should be emphasized that this is only the assessment of one stock market expert. In contrast, other voices believe that Bitcoin will continue to rise. Some even believe that the cryptocurrency could reach a value of up to 200,000 US dollars in the coming months.

Moreover, JPMorgan has a reputation for being skeptical about Bitcoin for good reason. It is therefore not surprising that they are predicting a deep fall for the cryptocurrency. What is certain is that this example once again makes it clear that investing in Bitcoin and co. is almost tantamount to gambling. We are waiting with bated breath to see how the price will develop as a result of the upcoming halving.