Earlier this week Corsair announced that it intends to start its IPO.

Corsair Gaming Inc.

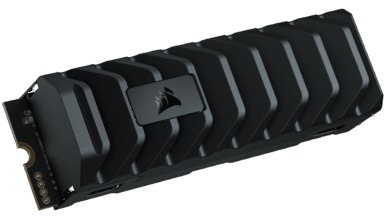

Corsair is a world-renowned manufacturer of top-of-the-line hardware for the gaming community and content creators.

Corsair Gaming manufactures various high-performance devices, including keyboards, various computer components, headsets, or even complete gaming PCs. Corsair’s product range includes streaming accessories, gaming components and software.

Corsair Gaming Inc. submitted an application for an initial public offering in 2010, but this was postponed indefinitely. But now the time has come. The IPO is scheduled to start on September 22, 2020.

IPO

The IPO will start with 14,000,000 common shares. Of these, Corsair itself holds 7,500,000 and the remaining 6,500,000 are to be offered for sale.

The price per share will range between $16.00 and $18.00. The shares will then be listed on the Nasdaq Global Market under “CRSR”.

At the moment, the offer is of course subject to market conditions. Therefore, it is not yet possible to say what size and what conditions it will have.

Lead book-running managers are acting as intermediaries for Corsair’s offering. In the case of Corsair, these are Goldman Sachs & Co. LLC, Barclays and Credit Suisse.

Lead book-running managers are responsible for the allotment and issuance of shares.

The offer is currently only available through a prospectus. The preliminary prospectus can be obtained from: Goldman Sachs & Co. LLC, Attention: Prospectus Department, 200 West Street, New York, NY 10282, by phone at 1-866-471- 2526 or by e-mail at spectusny@ny.email.gs.com;; Barclays, c / o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, by phone at 1-888-603-5847 or by e-mail at barclaysprospectus@broadridge.com;; or Credit Suisse, Attention: Prospectus Department of Credit Suisse, 6933 Louis Stephens Drive, Morrisville, North Carolina 27560, by phone at 1-800-221-1037 or by e-mail at usa.prospectus@credit-suisse.com.

The most important facts about the IPO summarized once again:

-

- Yield potential: 36%

- IPO date: September 22, 2020

- stock exchange: NASDAQ Global Market under the ticker: CRSR

- Sales in Q2 2020: $689 million

- EBIT in Q2 2020: $50 million

- Net profit in Q2 2020: $24 million