Last year, Facebook announced the development of a cross-company payment system that will also enable money transfers via WhatsApp. A first public test was to take place in Brazil. With 120 million active WhatsApp users, the South American country is one of the US software giant’s most important markets.

Now, a decision by the Brazilian central bank has led to an abrupt end to the test phase of the WhatsApp Pay payment system. Before the payment system can be restarted, the authority demanded a preliminary analysis of the effects of the service. It fears that the introduction of the system controlled by Facebook could have a negative impact on competition and efficiency in payment transactions and that the privacy of users would be further undermined by further information.

Retailer or provider ?

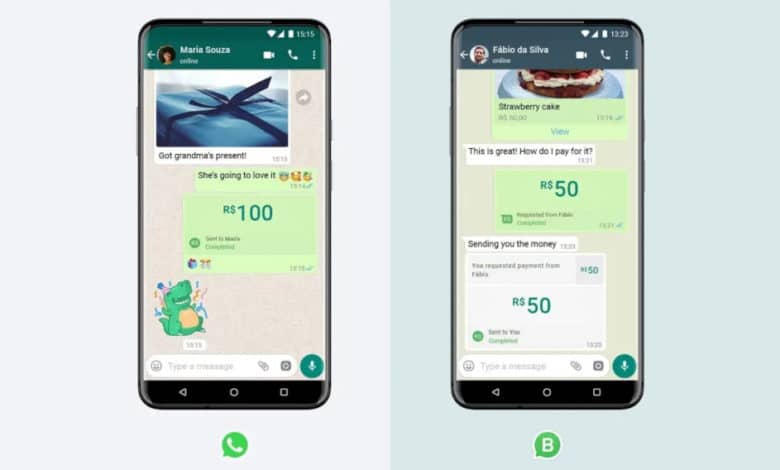

According to a report by the news agency Reuters, Facebook argues that WhatsApp Pay is merely a mediation service and therefore does not require approval from the central bank. Money is transferred through WhatsApp Pay, where users either deposit a credit card or link their Paypal account. Then, with just one click, money can be transferred to private contacts or companies. The usage is very similar to WeChat Pay and Alipay, which dominate the market for mobile payment solutions in China.

In addition, businesses have the opportunity to advertise their products directly in Messenger, which can then be paid for via WhatsApp Pay. There is probably no shorter path between offering and buying on the Internet at present. To prevent unauthorized payments, users only have to log on to their smartphone with a six-digit PIN or fingerprint.

Transactions via Mastercard and Visa stopped

The credit card companies Mastercard and Visa also received a request from the central bank not to execute all transactions made via WhatsApp Pay. According to a statement to Reuters, WhatsApp Pay is currently working on a solution that will enable it to offer its payment service again in Brazil in cooperation with local banks and the central bank. In addition to the aforementioned concerns, a possible reason for the ban could also be the introduction of a similar payment system by the Brazilian central bank, which is scheduled to appear in the fall. According to WhatsApp, the system called Pix could also be integrated into the Messenger.