Just a few months ago, industry experts were predicting a rosy future for Fisker. Some even believed that the US manufacturer would be able to compete with Tesla. But the reality is different. The company, which focuses on electric cars, is now apparently on the brink of collapse.

Fisker has money problems

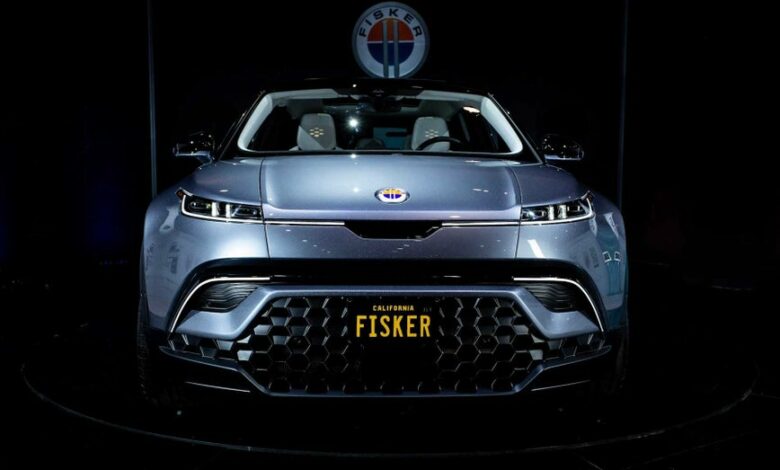

With the Fisker Ocean, the US manufacturer actually wanted to break into completely new spheres of success. The technical data was also right. For example, the Fisker Ocean Extreme was supposed to score points with an impressive range of 707 km. But the dream is apparently over. There are increasing indications that Fisker is in serious financial difficulties. Last week, for example, the company failed to make a high interest payment. However, the company is supposed to have had the necessary money on the high edge.

The fact that Fisker has still not presented any annual figures for 2023 without further ado also seems strange. What really makes us skeptical is the fact that the production lines in Austria have been stopped. The Fisker Ocean is produced there. Looking at the public figures, however, the question quickly arises as to why the manufacturer should produce at all. After all, Fisker currently has around 4,700 unsold cars in stock.

However, demand is low in view of the uncertain future. After all, car buyers want to be able to rely on long-term support and not get involved with a company that will soon go bankrupt. The search for investors is also going very badly. Fisker actually wanted to build up an extensive sales network and sell its vehicles through car dealers. But here, too, some interested parties seem to have pulled their legs in for fear of the car manufacturer’s future.

Threat of exclusion from stock market trading

Meanwhile, the financial world seems to be preparing for the end of Fisker. The New York Stock Exchange, for example, is already openly threatening to exclude the car manufacturer from stock market trading. After all, the share price has been below one US dollar for over a month. The fact that the company is still able to keep its head above water is probably thanks to a Polish investor, as reported by Reuters. But even this investor does not seem to be convinced that Fisker has a rosy future. For this reason, strict liability regulations have been agreed between the contracting parties.

Should the car manufacturer really sink into bankruptcy, then it is liable with everything that is still there. And according to the company, that is probably around 121 million US dollars. On top of this, the lenders and part-owners are to provide an additional 150 million US dollars. But this will not come in one go. Rather, the money is to be given bit by bit, which of course makes it all the more difficult for Fisker. Another source of uncertainty is that investors can withdraw their money at any time and exchange it for shares. In order to receive the first part of the cash payment, the manufacturer must first present its balance sheet for 2023.

As this has still not happened, one must assume, for better or worse, that it is more likely to deter than attract new investors. Furthermore, there could be a lurking fear that incorrect sales forecasts will come to light. Should this be the case, a fine could be imposed on top, as was the case with Apple, for example. In addition to the bare figures, the manufacturer must also demonstrate a new partnership with a well-known car manufacturer. These are all pretty high hurdles for the manufacturer to overcome. We are curious to see how the misery will end.